At PhysioNow, we receive many inquiries from our patients about our direct billing services. If it is your first time using your insurance and are unsure about the whole process, this article should help you out. Additionally, you are free to reach out to us for more personal questions and our team of experienced administrative staff would be more than happy to help you out.

What is direct billing?

Direct billing means that the clinic can submit the claims on your behalf to your insurance provider. Ultimately, this results in a streamlined process for our patients as you no longer have to pay at the clinic, submit the claim, and then wait for reimbursement. Instead, you are only responsible for paying the amounts, if any, not covered by your insurance plan.

Which insurances can PhysioNow bill to?

We bill to all the top extended health care providers including Sunlife, Manulife, Desjardins, Canada Life, Blue Cross, Greenshield, Johnson and more. We are able to bill to a long list of extended health care providers, which you may find here. Please note, this is not an all-inclusive list but rather the most common providers. If you do not see your provider on the list, you may call our offices and have them check for you.

How much does my plan cover?

This will be dependent on your individual plan and extended health care provider. Usually, insurance providers only release information to the insured member. Sometimes, you may have to call them or they may have provided you a login to a portal where you can check on the status of your benefits. Generally, for a health care claim, plans have a maximum coverage total within the year (ex. $1000) and a per claim maximum either as a % or a set dollar amount (ex. covers 80% or covers up to $60 of each session).

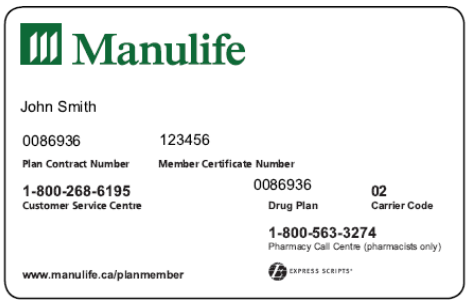

What do I need to bring to my appointment?

You will need your plan details with you in order to do direct billing at your first appointment. You may have a physical or digital insurance card with all the details that looks something like the image above that we can photocopy, or you can email to us. Then, you will proceed with the appointment and our administrative staff can bill your insurance while you’re inside. Once you’re done, our staff will be able to let you know how much your insurance covered (if you didn’t already know this information), and whether there is any co-pay to be covered by you. And that’s all! Direct billing makes the process very simple.

What if I have more than one type of coverage?

We can direct bill to multiple plans at the same time! We will submit to your primary plan first, and any outstanding balances we will submit to the secondary plan. This is true even if your benefits are from 2 different insurance providers. This is referred to as a coordination of benefits, or COB. It allows people with more than one benefits plan (whether from their own insurance, a spouse, or parent) to combine and thus, maximize their coverage.

What are the benefits of direct billing?

Now that we have been over the basic of direct billing, let’s talk about why it is important to you, and why our patients love it.

- Convenience: It saves you the time and effort from having to navigate the claims website and submitting claims by yourself

- Pay less upfront: You only have to pay the portion not covered by your insurance instead of paying the full amount and awaiting reimbursement

- Predictable expenses: Knowing what your insurance covers right away can help you plan and budget for other expenses

Looking for treatment?

PhysioNow is here to help you get started. We offer direct billing for Physiotherapy and Massage Therapy so that you can get treated quickly and efficiently. Book with PhysioNow today for your first assessment and treatment!

Leave a Reply